| The cash drawer feature must first be activated, in Setup Banking. The deposit method used for each customer payment you receive is determined in the Payment Method setup. |

|

Cash Drawers and Deposits |

Previous Top Next |

Menu Navigation

Lists ... Banking ... Cash Drawers

Lists ... Banking ... Deposits

Activities ... Banking ... Cash Drawer ...

Activities ... Banking ... New Deposit

About Cash Drawers and Deposits

Cash Drawers and Deposits are a convenient way of controlling and reconciling a cash drawer and grouping payments for recording into the general ledger. Funds may be deposited using one of four convenient methods:

| Cash Drawer Method | Customer Payments are automatically grouped by location and/or employee for deposit. This method is normally used in retail environments. |

| Delayed Group Method | Customer Payments are selected individually by the user for inclusion on the deposit. This is most commonly used and associated with credit cards. |

| Miscellaneous Method | Non-accounts receivable related deposits are entered using this method. |

| Direct to GL Method | Customer Payments are automatically posted to the desired bank/expense GL account when entered. |

Cash drawers and deposits allow you the opportunity to monitor monies coming into the company, and to have strict controls over funds that are deposited. You can also be alerted to any shortages (or overages) by an employee or location.

| The cash drawer feature must first be activated, in Setup Banking. The deposit method used for each customer payment you receive is determined in the Payment Method setup. |

In this Topic

Field by Field Help - Cash Drawer Deposits

Field by Field Help - Delayed Group Deposits

Field by Field Help - Miscellaneous Deposits

Q & A - Cash Drawers and Deposits

Related Topics

3.7 Setup Banking

13.1 Bank Accounts

13.2 Payment Methods

Cash Drawer deposits are designed to be used in a POS environment, where it is necessary to control and balance cash receipts made by employees and/or locations. The process involves opening a cash drawer based on either location or employee ID (determined by the choice made in Setup Banking), having that employee accept and enter payments into ManageMore, and then closing the drawer later in the day. The drawer can then be posted immediately, or it can be closed awaiting posting by another employee at a later time. Funds can also be added to or removed from the deposit to reflect any amounts that may were not related to customer payments. Amounts can also be left in the drawer and not deposited.

Field by Field Help - Cash Drawer Deposits

Buttons

Close Cash Drawer

Click this button to close the current cash drawer. This will only be available on open cash drawer records.

Post Cash Drawer

Click this button to post a closed cash drawer. This will only be available on closed cash drawers when drawers have been set up to not post automatically. See Setup Banking to set this properly.

Attach documents to this record

Click this button to view or attach documents to this record in the Intellifile Explorer.

Fields

Reference Name

Enter a name by which this deposit can be found quickly and easily on the list of cash drawers and deposits.

Figure 13-2. Closing and Posting a Cash Drawer

Date Entered

Displays the date this cash drawer information was entered.

Location

Displays the location of the cash drawer record.

Deposit ID

Displays the internally generated deposit ID assigned to this cash drawer record. This number cannot be changed.

Beginning Cash Drawer Balance

Enter the amount in the drawer at the beginning of the day (the bank amount). This amount can be compared against the previous day's ending cash drawer balance for continuity.

Calculate Money

Click this button to open the Calculate Money Tool window. This window aids the user in determining the exact amount in the cash drawer by entering the amount of each denomination found in the drawer. After entering this information and saving it, the balance will be marked Counted instead of Uncounted as is default in the cash drawer record when it is first opened.

Cash Drawer Payments Received

Displays the amount of payments received into the cash drawer. This is only visible during the posting of the cash drawer record.

Minus Cash Drawer Payouts

Displays the amount of payouts made through this cash drawer while it was open. This is only visible during the posting of the cash drawer record.

Payments Posted Directly to GL

Displays the total of the payments that were posted directly to the GL as defined in the payment method and not into the cash drawer even though the payments matched the drawer's criteria. This is only visible during the posting of the cash drawer record.

Amounts added to / (subtracted from) the cash drawer

Displays the amount of monies added to or subtracted from the cash drawer for various miscellaneous reasons. Click on the hyperlink to add or subtract monies as needed from particular GL accounts. This is only visible during the posting of the cash drawer record.

Ending Cash Drawer Balance

Enter the amount in the drawer at the end of the day (the bank amount). If the drawer is to be posted automatically after closing, the default amount will be placed in this field. If the drawer is not posted automatically after closing, no default amount will be put in the field (the software will wait for an amount to be entered by the user).

Calculate Money

Click this button to open the Calculate Money Tool window. This window aids the user in determining the exact amount in the cash drawer by entering the amount of each denomination found in the drawer. After entering this information and saving it, the balance will be marked Counted instead of Uncounted as is default in the cash drawer record when it is closed.

Document No.

Enter the deposit slip number or other identifying number for this cash drawer record. This is only visible during the posting of the cash drawer record.

Bank Name

Select the bank account where the monies from this cash drawer are being deposited. This is only visible during the posting of the cash drawer record.

Deposit Amount

Enter the amount being deposited to the bank. You can use the Calculate Money button to aid you in determining the total deposit amount. This is only visible during the posting of the cash drawer record.

Ending Cash Drawer Balance

Displays the grand total of money both left in the drawer and being deposited into the various bank accounts. This is only visible during the posting of the cash drawer record.

Cash Drawer (Overage/Shortage/in Balance)

Displays whether the cash drawer is in balance, or if the drawer is over or short, and what amount the overage or shortage is. This is only visible during the posting of the cash drawer record.

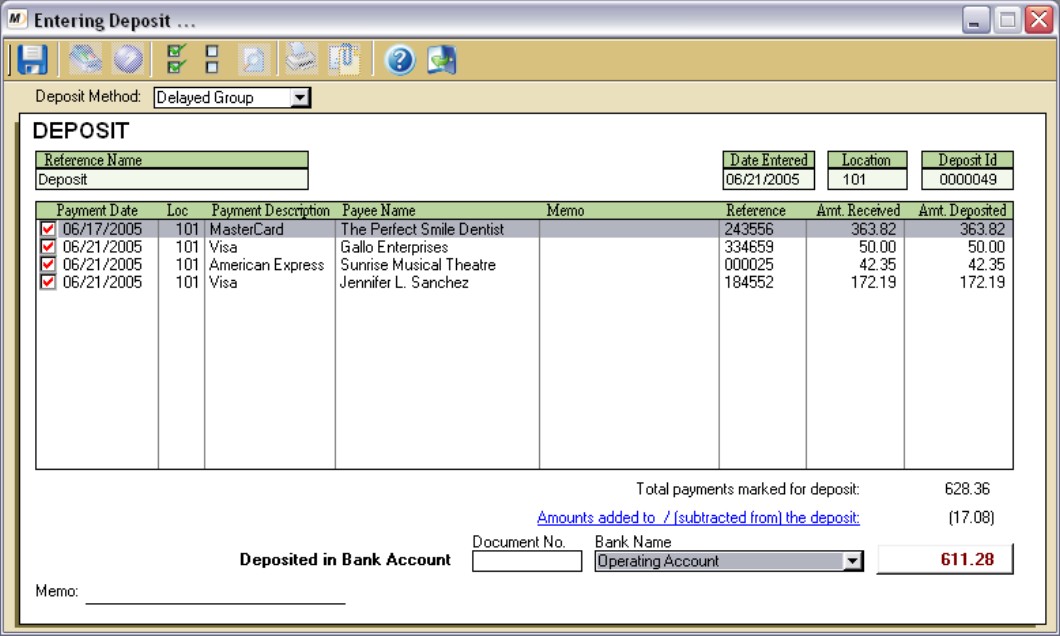

Delayed Group Deposits are best suited for times when a payment is received, but when actual payment is not deposited or posted until some point in the future. ManageMore allows these payments to be held until such time as they are marked for deposit. This is mainly beneficial for credit card payments, where the funds are deposited into your bank account, days after the payment is processed. This method can also be used for businesses who do not operate in a POS environment. You may optionally add or subtract funds from this deposit as well, depending on whether any funds were removed by your company, or possibly for another reason, such as fees being paid from the deposit amount.

Field by Field Help - Delayed Group Deposits

Buttons

Mark multiple payments for deposit

Click this button to mark all payments for deposit or to mark specific payments based on specific criteria, such as payment method, and date range.

Unmark multiple payments for deposit

Click this button to unmark all payments for deposit or to unmark specific payments based on specific criteria, such as payment method, and date range.

Attach documents to this record

Click this button to view or attach documents to this record in the Intellifile Explorer.

Fields

Reference Name

Enter a name by which this deposit can be found quickly and easily on the list of cash drawers and deposits.

Date Entered

Displays the date this cash drawer information was entered.

Location

Displays the location of the cash drawer record.

Deposit ID

Displays the internally generated deposit ID assigned to this cash drawer record. This number cannot be changed.

Payment Date

Displays the date the payment was first created.

Loc

Displays the location recorded on the payment.

Payment Description

Displays the payment method used for this payment.

Payee Name

Displays the name of the customer (if any was recorded) who made the payment.

Memo

Displays the memo note from this payment record, if any.

Reference

Displays reference information recorded on the payment record (i.e. check number).

Amt. Received

Displays the amount received on the payment record.

Figure 13-3. Delayed Group Deposit

Amt. Deposited

Displays the amount deposited for this payment in this deposit record.

Total payments marked for deposit

Displays the total monetary amount for all marked payments.

Amounts added to / (subtracted from) the deposit

Displays the amount of monies added to or subtracted from the deposit for various miscellaneous reasons. Click on the hyperlink to add or subtract monies as needed from particular GL accounts.

Document No.

Enter the deposit slip number or other identifying number for this deposit record.

Bank Name

Select the bank account where the monies in this record are being deposited into.

Deposited in Bank Account

Displays the total amount of monies being deposited into the account.

Miscellaneous Deposits are intended to be used when other traditional deposit methods are not relevant to use. It is utilized when funds are coming into the company's bank accounts from a source other than customer payments. You can enter or select the general ledger account that best describes where the monies are coming from and the bank account to which they are going to. Examples of miscellaneous deposits would include interest earned from a bank, or perhaps a vendor refund check.

Field by Field Help - Miscellaneous Deposits

Buttons

GL Lookup

Click this button to search for a general ledger account number.

Attach documents to this record

Click this button to view or attach documents to this record in the Intellifile Explorer.

Fields

Reference Name

Enter a name by which this deposit can be found quickly and easily on the list of cash drawers and deposits.

Date Entered

Displays the date this cash drawer information was entered.

Location

Displays the location of the cash drawer record.

Deposit ID

Displays the internally generated deposit ID assigned to this cash drawer record. This number cannot be changed.

GL Account

Enter the GL account number that is to be affected by this miscellaneous deposit. You can optionally click on the Lookup GL Account at the top of the window, or press Ctrl + L while the cursor is flashing in this field to look up the General Ledger account number.

Account Description

Displays the long description of the GL account number previously entered.

Item Number

Enter an item number that describes this entry (i.e. check number, deposit number, etc.).

Item Description

Enter a description for this miscellaneous entry.

Amount

Enter the amount of this miscellaneous entry.

Document No.

Enter the deposit slip number or other identifying number for this deposit record.

Bank Name

Select the bank account where the monies in this record are being deposited into.

Deposited in Bank Account

Displays the total amount of monies being deposited into the account.

If your company has many drawers open at one time, looking for your own may become a tedious task. By clicking on Activities ... Banking ... Cash Drawers ... My Cash Drawer Activities, you can see only the drawer(s) that you are responsible for. You can then edit or clsoe the drawer by simply double clicking on it, or by selecting it then clicking the Edit button on the window's toolbar.

Dr |

Cr |

|

Bank GL Account (From Bank Account) |

XXXX |

|

Undeposited Funds GL Account (From Setup Accounting) |

XXXX |

|

Miscellaneous GL Accounts (From Miscellaneous Deposit Form) |

XXXX negative |

XXXX positive |

Over/Short GL Account (From Setup Accounting) |

XXXX when short |

XXXX when over |

Q & A - Cash Drawers and Deposits

| Q01. | Do I have to make a cash drawer immediately upon entering the program on my first login of the day? What if I have to take a sale before I do this? |

| A01. | You can create a cash drawer at any point during the day. The program will the total up the amounts you have already collected on transactions since the previously closed cash drawer, and will keep the running total, so that the amount at the end of the day will be correct. |

| Q02. | What should I do if I get a bad check from the bank? |

| A02. | If you use the cash drawer method for the check payment method, then the reversal amount will be subtracted from the amount of checks in the drawer of the employee or location where the reversal took place. If the delayed method is used, simply select it the next time a deposit is done. |

| Q03. | I use the delayed group method of depositing for my credit card payments. How do I account for the credit card fees? |

| A03. | When checking off those payments that have been received by your bank, click on the hyperlink at the bottom of the window. Then enter the GL account number that corresponds to your credit card fees account and enter the total amount of the fees that were withheld by the merchant. |

| Q04. | I don't see my question here. Where else can I get information? |

| A04. | Visit our website's Technical Support section. |

|

|

|

| © 2015 - Intellisoft Solutions, Inc. All rights reserved. | |

| Other Related Links | |

| Business Software | Cellular Software | Pager Software | Business Management Software |