Pay Taxes |

Previous Top Next |

Menu Navigation

Lists ... Company ... Tax Payments

Activities ... Company ... Pay Taxes [Pay Sales and Use Tax]

About Tax Payments

Pay Taxes allows your company to create a permanent record of the taxes you collect on behalf of, and remit to your taxing authority. In addition to using a wizard style format, it automatically creates a transaction (purchase receipt or disbursement) to record in your company's database, thereby allowing the tax payment process to be completed in one step. A useful report is also produced, to assist in the completion of required tax returns.

This feature requires activation in Setup Banking. Please note that this feature may not be included in your software license.

In this Topic

Field by Field Help - Pay Taxes screen

Related Topics

3.1 Setup Company

6.8 Tax Codes

10.1 Vendors

10.5 Purchase Receipts

10.6 Disbursements

| 1) | Select the Pay Taxes menu option. |

| 2) | Choose the taxes to pay and click Next. |

| 3) | Fill in authority and location information and the date range of invoices to remit tax monies for, then click Next. |

| 4) | Choose whether to calculate taxes to remit based on accrual or cash-based accounting, then click Next. |

| 5) | Select taxes to pay then click Next. |

| 6) | Choose whether to create a disbursement to pay the taxes now, or a purchase receipt to pay the taxes later, then click Next. |

| 7) | Save the transaction, then choose to print a detail or summary tax report. |

Field by Field Help - Pay Taxes screen

Welcome to the Pay Company Taxes Wizard

Pay taxes levied on

Select what kind of taxes should be paid through this wizard.

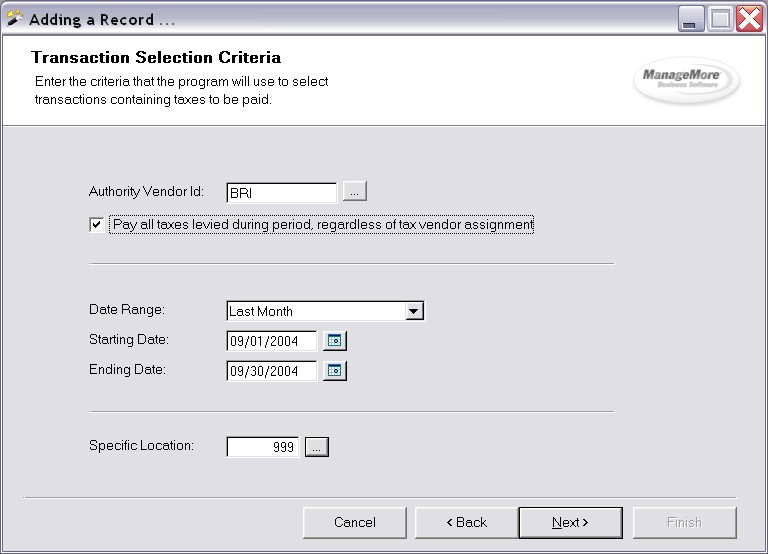

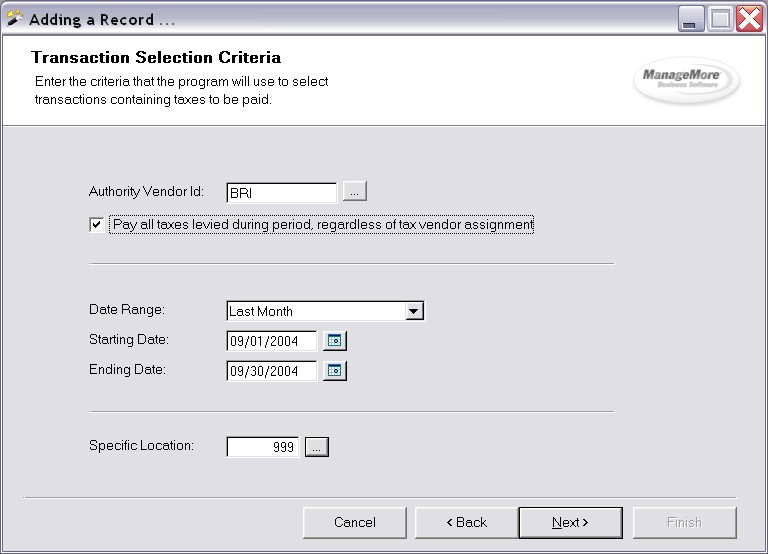

Transaction Selection Criteria

Authority Vendor ID

Enter or select the vendor ID of your tax collection authority.

Pay all taxes levied during period, regardless of tax vendor assignment

When checked, all taxes will be added up and paid to the one authority vendor previously selected. When not checked, ManageMore will select only those taxes that are defined with that vendor ID in the tax codes.

Figure 13-5. Pay Taxes Wizard

Date Range

Select the invoice date range that ManageMore should review for taxes to be remitted.

Starting Date

Enter or select the start date for the period that ManageMore should review for taxes to be remitted. Manually entering a date here will cause the date range to take a value of Custom.

Ending Date

Enter or select the end date for the period that ManageMore should review for taxes to be remitted. Manually entering a date here will cause the date range to take a value of Custom.

Specific Location

Enter or select a location number for which to pay taxes. Leaving this field blank will pay taxes from all locations.

Tax Basis

Accrual/Cash

Select whether ManageMore should use accrual-based or cash-based accounting when determining the amount of taxes to remit to the taxing authority.

| Please consult with your accountant or bookkeeper as to which method is acceptable by your taxing authority. |

Tax Selection

To select or deselect one of the taxes here for remittance, double click on the checkbox on the left side of the tax line item.

Tax Name

Displays the type of tax being remitted.

GL Account

Displays the GL Account number that was defined in the tax code for this tax type.

Calculated Amount

Displays the total amount calculated by the software.

Amount to Pay

Displays the amount of tax being paid by your company against the total tax calculated.

Total Taxes to be Paid

Displays the total amount of taxes selected, the sum of all selected tax line items.

Discount Amount

Enter the discount amount, as authorized by your taxing authority, allotted for early payment of taxes. This discount amount will be entered into the discount field of the purchase receipt/disbursement to be created.

Total Amount to be Paid

Displays the total amount of taxes to be paid, the total taxes minus the discount amount.

Tax Payment Action

What would you like to do with the amount to be paid?

Choose what kind of transaction should be created to satisfy the tax payment:

| Create a disbursement to pay now | Select this option if you want to immediately set up payment and a purchase transaction to satisfy this tax obligation. You will need to select a bank account when utilizing this option. The selected bank account will then be used on the disbursement. |

| Create a purchase receipt to pay later | Select this option to only create the purchase document immediately, and defer payment until the Pay Bills process is run or a manual disbursement is created. |

| Canceling the disbursement or purchase receipt will cause ManageMore to come back to this phase of the Pay Taxes Wizard. |

Tax Report Print Options

Please make a selection

Choose whether to print out a summarized tax report, or a detailed tax report. The summary report will contain a listing of transaction amounts and the taxes that were calculated from them. The detailed report has this information as well as a listing of all transactions and the amount of tax collected for each one.

| Q01. | How do I implement a change in tax rates? |

| A01. | Enter a new tax code record, using the same code, but with a new effective date and new rates. On the effective date, the new rates will automatically take effect. |

| Q02. | How can I use the VAT/GST features of ManageMore? |

| A03. | Go to the General options section of Setup Accounts Payable. Select the option to "Allow tax on purchases for VAT/GST." |

| Q03. | I don't see my question here. Where else can I get information? |

| A03. | Visit our website's Technical Support section. |

|

|

|

| © 2015 - Intellisoft Solutions, Inc. All rights reserved. | |

| Other Related Links | |

| Business Software | Cellular Software | Pager Software | Business Management Software |